Good day valued readers,

We hope this week's carefully curated selection of news finds you well. In this edition, we cover the latest developments across investing, finance, crypto, AI, and other topics to help you stay informed.

As always, our goal is to provide you with a professional, unbiased roundup of noteworthy news to augment your understanding of what's happening in the world. We take pride in hand-selecting articles from trustworthy sources across a diverse range of industries.

Please enjoy this week's newsletter. We're grateful for the opportunity to share these insights with you and look forward to continuing to be a valuable resource.

Read time: 7 minutes

Sign Up to this newsletter.

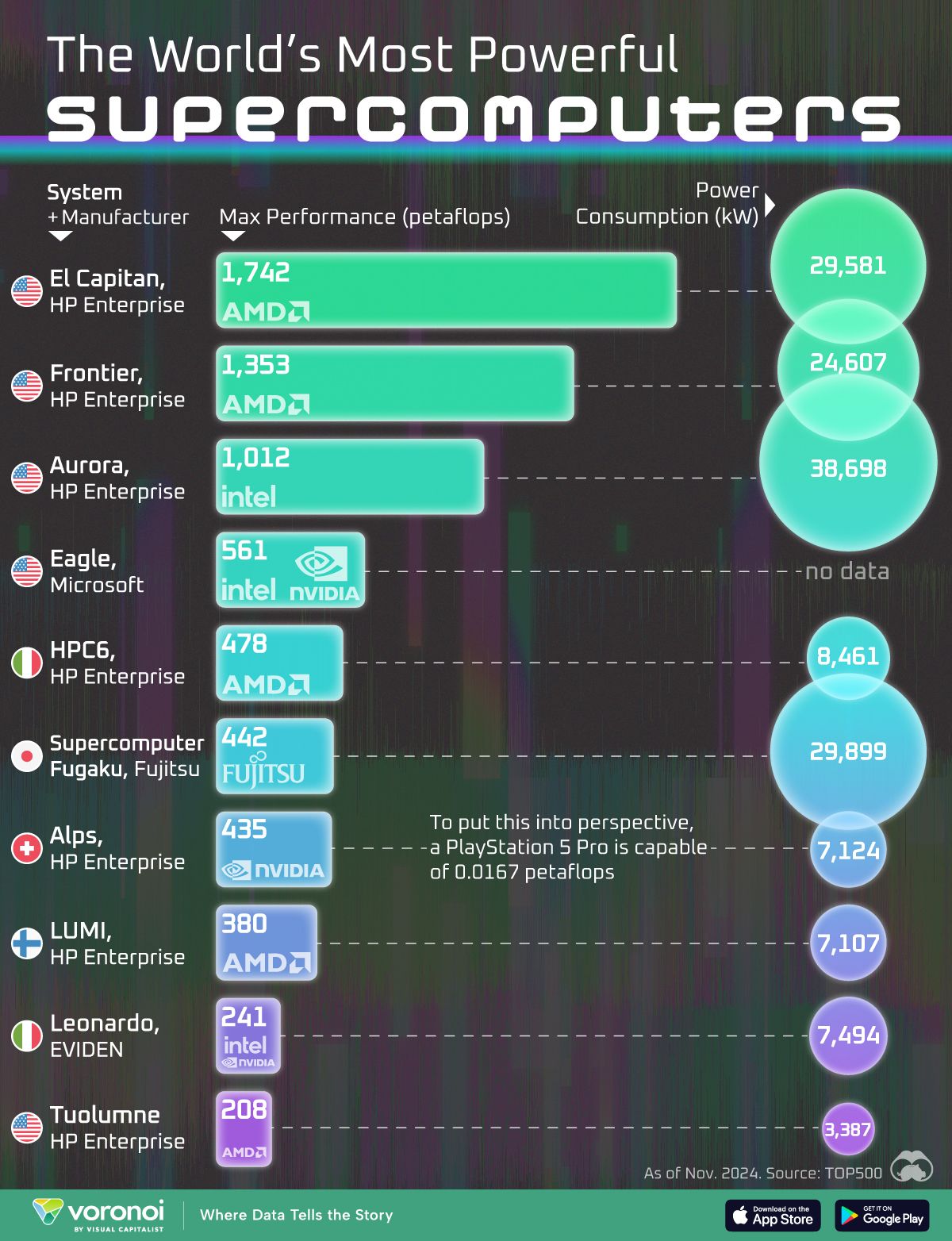

Image of the week

Quote of the week

Get Booked on 3.8 Million Podcasts Automatically

Stop wasting time – 2025 is going by fast. If you finally want to be a regular podcast guest in your industry, PodPitch.com will make it happen. Even the beehiiv team uses it!

Imagine snapping your fingers & getting booked on the exact podcasts your customers are already listening to…

With PodPitch.com, it takes 60 secs to start emailing tons of podcast hosts to pitch YOU as the perfect next guest.

Sync your email address

Load in your brand info

Click "go"

Now, you've just automated thousands of personalized emails pitching YOU as the PERFECT next podcast guest. Sit back and relax as you watch the emails send out from your email address.

Big brands like Feastables, Jack Links, and hundreds more are already using PodPitch.com instead of expensive PR agencies.

PodPitch.com is so confident in their tech that they'll give you a FREE Starbucks gift card if PodPitch.com isn't the most impressive 20 minute demo you've ever seen.

Ready to make 2025 your year?

Your best year starts here

Make 2025 your most successful year yet. Join HoneyBook in January to jumpstart your business with all the tools you need to manage client relationships—Plus a chance to win $10,000 in prizes.

What Top Execs Read Before the Market Opens

The Daily Upside was built by investment pros to give execs the intel they need—no fluff, just sharp insights on trends, deals, and strategy. Join 1M+ professionals and subscribe for free.

Investing and Finance

Welcome to this week's market digest, where the financial landscape continues to evolve at a breathtaking pace. As we navigate through a fascinating period in global markets, all eyes are on the potential reshaping of social media giant TikTok, with both Frank McCourt and Elon Musk emerging as potential buyers in what could be one of the largest tech deals of the year. Meanwhile, the investment world is witnessing a remarkable milestone as BlackRock achieves record-breaking assets under management, even as debates intensify about the role and impact of passive investing in today's market.

The German economy's continued contraction serves as a sobering reminder of the economic challenges facing Europe, while Meta's significant workforce reduction signals ongoing adjustments in the tech sector. As the World Economic Forum kicks off in Davos, discussions are dominated by artificial intelligence, cryptocurrency, and the potential impact of the upcoming U.S. presidential election on global markets. Boeing's struggles and the unprecedented market conditions we're experiencing add layers of complexity to an already intricate financial narrative.

In this edition, we'll delve deep into these stories, examining their interconnections and what they mean for investors navigating this dynamic landscape.

Who Is Frank McCourt, The Billionaire Trying To Buy TikTok? - Read more

China discusses TikTok sale to Elon Musk as potential option- Bloomberg - Read more

German economy shrinks for second consecutive year - Read more

US earnings latest: BlackRock shares jump as revenue beats expectations - Read more

Is There a Problem with Passive Investing? - Read more

Here’s How Much Elon Musk Could Buy TikTok For—As China Reportedly Eyes Deal - Read more

Meta is cutting 5% of its workforce, or more than 3,600 employees - Read more

Boeing closes the books on a terrible 2024 - Read more

6 Asset Allocation Strategies That Work - Read more

BlackRock Stock Rises as Firm Sets Record for Assets Under Management - Read more

Mag 7, crypto, AI, Trump, tariffs, Fed, and everything else that will dominate Davos - Read more

The stock market has never looked like this before — regardless of who's president - Read more

Crypto News

Welcome to this week's crypto chronicle, where the digital asset space is experiencing unprecedented momentum and historical milestones. Bitcoin's spectacular rally to $109,000 has captured global attention, coinciding with growing anticipation surrounding Donald Trump's potential return to the White House and his newly declared crypto-friendly stance. The regulatory landscape is evolving rapidly, with Senator Cynthia Lummis taking a bold stand against the FDIC's approach to crypto oversight, while the Department of Justice makes headlines with its $9 billion Bitfinex case resolution.

NYDIG's latest analysis confirms crypto's remarkable performance in 2024, demonstrating its decreasing correlation with traditional assets and reinforcing its position as a leading investment class. The institutional adoption continues to accelerate, with Switzerland's PostFinance entering the ETH staking arena and centralized exchanges recording unprecedented trading volumes. As traditional financial powerhouses prepare to launch new crypto investment vehicles, including a potential Litecoin ETF, Ethereum's ecosystem is poised for growth with Vitalik Buterin announcing plans to expand the Ethereum Foundation's talent pool.

This week, we'll explore these developments and their implications for the future of digital assets.

Bitcoin Stocks Pop as Crypto Rallies Ahead of Trump Inauguration - Read more

Sen. Cynthia Lummis Accuses FDIC of Crypto Oversight Misconduct, Demands Accountability - Read more

Bitcoin Beat 'Every Asset Class' in 2024 as Correlations Fell in Q4: NYDIG - Read more

Litecoin ETF Could Attract Up to $580M of Inflows If Adoption Mirrors That of Bitcoin ETFs - Read more

Swiss state-owned bank PostFinance launches ETH staking - Read more

Monthly crypto trading on CEXs hits all-time high in December: CCData - Read more

DOJ Says $9 Billion in Bitcoin Stolen in 2016 Hack Should Be Returned to Bitfinex - Read more

Buterin: Ethereum Foundation to Bring In Fresh Talent - Read more

Bitcoin Surges to $109K, Hits Record High Ahead of Donald Trump's Inauguration - Read more

Donald Trump is set to make cryptocurrency a national priority - Read more

Artificial Intelligence

Welcome to this week's AI intelligence briefing, where the landscape of artificial intelligence continues to evolve with groundbreaking developments and strategic shifts. OpenAI remains at the center of attention, making waves with both its revised policy approach to AI bias and its ambitious expansion into longevity research, while simultaneously strengthening its partnerships in the news industry through a collaboration with Axios. The practical applications of AI are showing remarkable promise, particularly in education, where Nigeria is pioneering an innovative approach to learning through AI integration.

While ChatGPT Pro demonstrates strong commercial success in early 2025, the industry faces important challenges, as highlighted by Apple's recent decision to pull back on AI-generated news notifications. The emergence of new players like MatterGen in materials science and Character AI's venture into gaming demonstrates the expanding horizons of AI applications. Meanwhile, the industry continues to see significant talent movement, with Mira Murati's startup attracting key executives from established AI companies.

As we witness the development of Ph.D.-level super-agents, it's clear that we're entering a new era of AI capabilities and possibilities.

OpenAI quietly revises policy doc to remove reference to ‘politically unbiased’ AI - Read more

From chalkboards to chatbots: Transforming learning in Nigeria, one prompt at a time - Read more

MatterGen: A new paradigm of materials design with generative AI - Read more

Apple is pulling its AI-generated notifications for news after generating fake headlines - Read more

ChatGPT Pro sales are off to a strong start in 2025 - Read more

Partnering with Axios expands OpenAI’s work with the news industry - Read more

Behind the Curtain — Coming soon: Ph.D.-level super-agents - Read more

AI startup Character AI tests games on the web - Read more

Mira Murati’s AI Startup Makes First Hires, Including Former OpenAI Executive - Read more

OpenAI is trying to extend human life, with help from a longevity startup - Read more

Top Article Picks this week

Welcome to this week's exploration of life, health, and human connections, where we dive into the wisdom that shapes our daily experiences and relationships. From the profound impact of ancestral diets on our modern well-being to the transformative power of meaningful conversations with grandparents, we're uncovering insights that challenge conventional thinking about personal growth and happiness. The emerging discourse around loneliness in our digital age has sparked both concern and entrepreneurial innovation, while new research continues to reshape our understanding of protein consumption and its role in optimal health.

The art of boundary-setting emerges as a crucial skill for modern life, alongside the surprising benefits of being an only child and the strategic advantage of schedule-building over traditional to-do lists. We're also examining the enduring value of re-reading beloved books and the economist's approach to life's complex decisions, all while exploring the depths of friendship formation in today's world. As quantum computing pushes the boundaries of possibility, we're reminded that the most meaningful advances often come from understanding and improving our connections with others.

Eight Words to Say to a Friend (Reading time: 3 min) - Read here

Should You Eat More Protein? (Reading time: 7 min) - Read here

An Economist’s Rule for Making Tough Life Decisions (Reading time: 5 min) - Read here

Quantum Computers Can’t Teleport Things—Yet (Reading time: 5 min) - Read here

How Far Would You Go to Make a Friend? A bunch of new start-ups are hyping the loneliness epidemic and are, of course, happy to offer solutions. (Reading time: 15 min) - Read here

The big idea: why it’s great to be an only child (Reading time: 5 min) - Read here

Working Well: Saying no is hard, but setting boundaries can improve your health (Reading time: 5 min) - Read here

You Are What Your Ancestors Didn’t Eat (Reading time: 3 min) - Read here

100 Questions To Ask Your Grandparents (Reading time: 4 min) - Read here

Be a Schedule Builder, Not a To-Do List Maker (Reading time: 12 min) - Read here

Why I Re-Read My Favorite Books Multiple Times A Year (Reading time: 4 min) - Read here

Want To Be Happier and More Successful? Learn To Like Other People (Reading time: 5 min) - Read here

Weekly YouTube videos

Investment Bonus

🎇 Earn passive income with up to 15% APY.

❄ Why invest with Debitum? 0%* default rate in 5 years. Licensed and Regulated platform. Business loans. Secured by real collateral. Sustainable returns 11 – 15% p.a. BuyBack obligation and other protection mechanisms. You will get 25 EUR by using our invitation link below.

Debitum - Your number one choice for investing in business loans - Join Here!

Book of the week

In his compelling collection "In Defense of Open Society," George Soros presents a powerful manifesto that interweaves personal experiences with philosophical insights and practical solutions for preserving democratic values. The book, published in 2019, arrives at a critical moment when open societies face mounting challenges from authoritarian forces, technological disruption, and nationalist movements worldwide. Soros draws from his unique perspective as a financial titan, philanthropist, and survivor of both Nazi and communist regimes to articulate why open societies matter now more than ever.

His analysis of artificial intelligence's potential threat to democracy is particularly prescient, highlighting how surveillance technologies and social media manipulation can undermine democratic institutions. The author's discussion of his "political philanthropy" through the Open Society Foundations provides fascinating insights into his strategic approach to defending liberal democracy and human rights globally. His candid reflections on founding the Central European University and its subsequent forced relocation from Budapest to Vienna serve as a compelling case study of the challenges facing academic freedom today.

The book's examination of financial markets and their relationship to political stability demonstrates Soros's deep understanding of how economic and political forces intertwine. His critical analysis of the European Union's structural weaknesses and potential solutions reflects both his commitment to the European project and his clear-eyed assessment of its shortcomings. While some readers might disagree with Soros's progressive political stance, his arguments for protecting open society values are thoughtfully constructed and deeply relevant to current global challenges.

The collection successfully combines theoretical frameworks with practical experiences, though at times the varying writing styles between essays can feel somewhat disjointed. Despite occasional repetition across chapters, Soros's passionate defense of liberal democracy and human rights remains consistently engaging throughout the book. This timely compilation serves as both a warning about the fragility of open societies and an inspiring call to action for their preservation. The book's greatest strength lies in Soros's ability to connect his personal journey with broader historical patterns and contemporary threats to democratic institutions.

Through these fourteen carefully crafted essays, Soros not only defends open society but also provides a roadmap for its survival in an increasingly complex world.

And finally…

Join Trading 212 Invest with this link, and we will both get FREE shares.

Thanks for reading!

If you like what you read, forward it to your friends, so they can sign up here.