Good day valued readers,

We hope this week's carefully curated selection of news finds you well. In this edition, we cover the latest developments across investing, finance, crypto, AI, and other topics to help you stay informed.

As always, our goal is to provide you with a professional, unbiased roundup of noteworthy news to augment your understanding of what's happening in the world. We take pride in hand-selecting articles from trustworthy sources across a diverse range of industries.

Please enjoy this week's newsletter. We're grateful for the opportunity to share these insights with you and look forward to continuing to be a valuable resource.

Read time: 8 minutes

Sign Up to this newsletter.

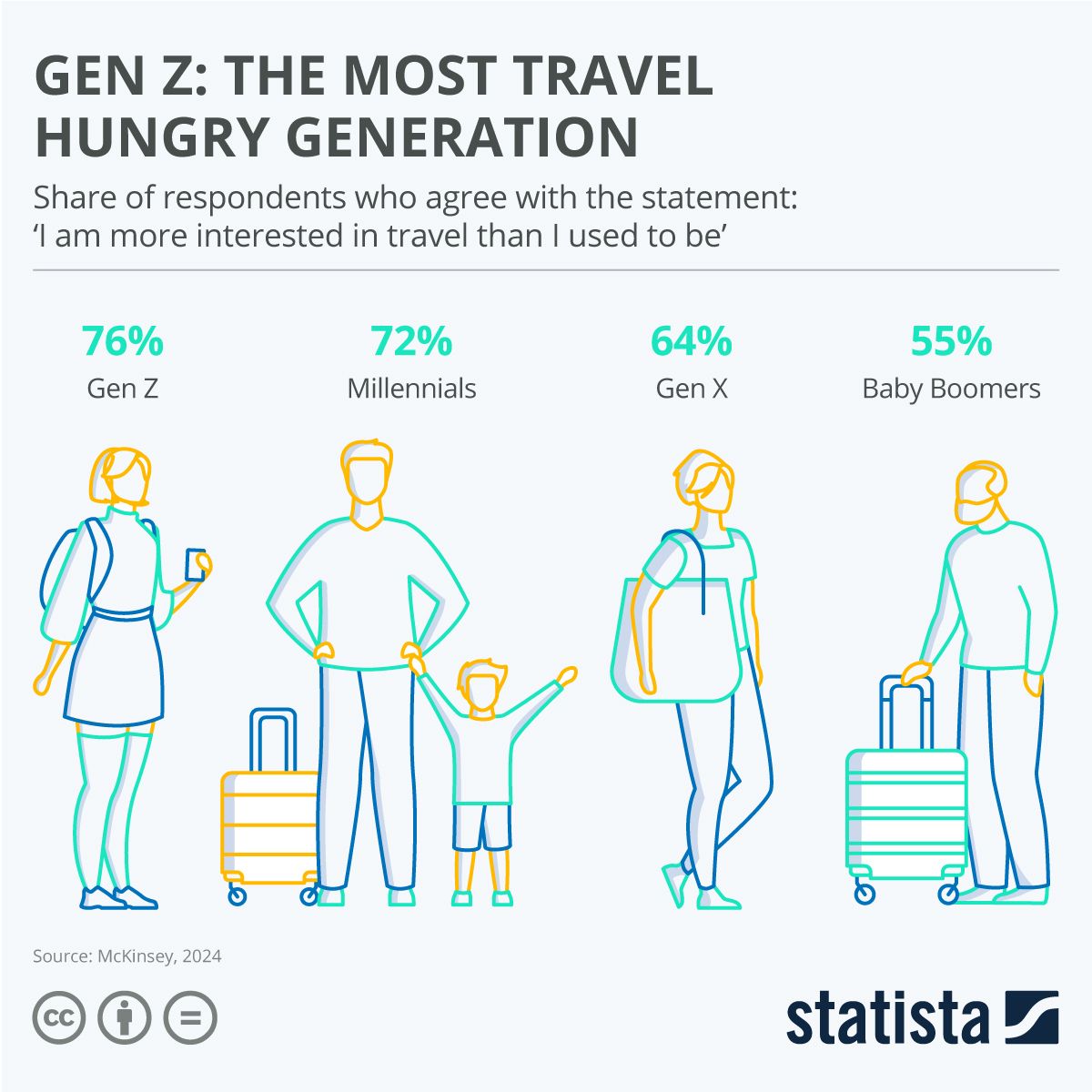

Image of the week

Quote of the week

Got NFL Season Tickets? Score Some Extra Cash With Lysted.

You’re the guy with the NFL season tickets, living the dream. But even the biggest fans miss a game or two. Instead of losing out, why not cash in? Lysted makes it easy to sell your NFL tickets on major sites like StubHub and Ticketmaster, all with just one listing. Forget the headaches of managing multiple platforms—Lysted does it for you, ensuring your tickets get sold fast, without the hassle.

Join this Viral Daily Trade Alert Subscription, Free

Receive daily stock trade alerts sent directly to your phone and email.

Stay informed with timely market insights and expert analysis.

Join a community of 150,000+ subscribers benefiting from these alerts

Stay ahead of market trends and capitalize on emerging opportunities.

Investing and Finance

Welcome to this week's financial roundup, where we dive into the latest market trends and corporate developments shaping our economic landscape. From shifting consumer behaviors to energy market dynamics, we've got you covered on the most impactful stories. Teen spending is on the rise, offering insights into emerging market trends, while OPEC adjusts its oil demand outlook, signaling potential shifts in the global energy sector.

In the financial world, banking giants Goldman Sachs and Bank of America have exceeded Q3 estimates, painting a picture of resilience in the face of economic uncertainties. Meanwhile, aerospace titan Boeing seeks to shore up its financial position with a substantial fundraising effort. Tech continues to make waves, with Apple reaching new stock heights on the back of product innovations, and Amazon joining the nuclear energy conversation.

As we look ahead, Nvidia is poised to dominate another earnings season, underlining the ongoing AI boom that's also bolstering TSMC's revenue projections. Join us as we unpack these stories and their implications for investors and market watchers alike.

Teens Are Spending More, Here's What They're Buying - Read more

OPEC Cuts Oil Demand Outlook, Again - Read more

Goldman Sachs Stock Rises as Results Surpass Estimates - Read more

Bank of America Joins Rivals in Topping Q3 Estimates - Read more

Boeing To Raise Up To $25 Billion, Gets $10B Credit Line - Read more

Apple Stock Rises to Fresh Record as Company Announces New iPad Mini - Read more

Three Things We Learned From Big Bank Q3 Earnings - Read more

Amazon Adds to Big Tech's Nuclear Push - Read more

Nvidia is set to dominate another Big Tech earnings season - Read more

TSMC Hikes Revenue Outlook in Show of Confidence in AI Boom - Read more

“The world is extremely interesting to a joyful soul.”

Crypto News

Welcome to this week's cryptocurrency and blockchain digest, where we explore the latest developments in the digital asset space. The crypto market continues to evolve rapidly, with institutional interest and technological advancements driving significant changes. Samara Asset Group's ambitious plan to expand its Bitcoin holdings through a substantial bond issuance highlights growing institutional appetite for digital assets.

Meanwhile, stablecoin giant Tether is exploring new avenues by considering lending to commodity traders, potentially bridging traditional finance and crypto markets. In the realm of crypto media and data, CoinDesk's strategic acquisition of CCData and CryptoCompare signals a consolidation of information services in the industry. Grayscale's move to transform its multi-token fund into an ETF reflects the ongoing push for more accessible crypto investment vehicles.

Bitcoin's recent outperformance of the S&P 500 has caught investors' attention, while overall crypto activity and usage have reached all-time highs according to the State of Crypto Report 2024. On the technical front, Ethereum co-founder Vitalik Buterin continues to shape the future of the network with proposals to address scalability and accessibility. Lastly, Tesla's significant Bitcoin move has sparked discussions about potential market impacts, underlining the ongoing influence of major players in the crypto space.

Samara Asset Group Plans up to $32.8M Bond to Expand Bitcoin Holdings - Read more

Crypto Company Tether Talking to Commodity Traders About Lending Them Its Billions - Read more

CoinDesk bolsters information services offering with strategic acquisition of CCData and CryptoCompare - Read more

Grayscale Looks to Turn Multi-Token Fund Into ETF - Read more

Bitcoin Has Outperformed the S&P 500 Since September - Here's Why - Read more

State of Crypto Report 2024 - Crypto activity and usage hit all-time highs - Read more

Bitcoin accumulation fuels market uptick signaling potential surge in price - Read more

Vitalik Buterin explains 3 ways Ethereum’s rollup-focused roadmap could resolve the trilemma - Read more

Vitalik proposes lowering Ethereum validator threshold from 32 to 1 ETH - Read more

Tesla's Massive Bitcoin Move Sparks Fears of Sell-Off - Read more

“Always forgive your enemies; nothing annoys them so much.”

Artificial Intelligence

Welcome to this week's AI and technology roundup, where we delve into the latest innovations and controversies shaping the future of artificial intelligence and tech. The AI landscape is buzzing with activity, from corporate strategies to ethical dilemmas and groundbreaking applications. OpenAI finds itself embroiled in a dispute with an obscure idea man, while tech giant Google backs new nuclear plants to power AI infrastructure. In the realm of AI computing, CoreWeave secures a massive credit facility to expand its cloud capabilities.

On the robotics front, a small startup collaborates with renowned designer Yves Béhar to bring humanoid robots into homes. AI's reach extends to mental health with an innovative AI-powered pet companion, though some experts question AI's current capabilities. The gaming world reflects on the transformative impact of the first GPU, which laid the groundwork for today's AI boom.

In fitness tech, Strava's new AI coach is making waves with its quirky commentary. Meanwhile, the New York Times challenges an AI startup over data usage, highlighting ongoing tensions between media and AI companies. As the AI race intensifies, the US government considers export restrictions on advanced AI chips, underscoring the technology's strategic importance.

Why OpenAI Is at War With an Obscure Idea Man - Read more

Google Backs New Nuclear Plants to Power AI - Read more

CoreWeave Closes $650 Million Credit Facility for AI Cloud-Computing Push - Read more

This three-person robotics startup is working with designer Yves Béhar to bring humanoids home - Read more

This $400 mental health pet companion is powered by AI - Read more

This AI Pioneer Thinks AI Is Dumber Than a Cat - Read more

Game-Changer: How the World’s First GPU Leveled Up Gaming and Ignited the AI Era - Read more

Fitness app Strava has a new AI coach—and its wacky comments are going viral - Read more

New York Times to Bezos-Backed AI Startup: Stop Using Our Stuff - Read more

US Weighs Capping Exports of AI Chips From Nvidia and AMD to Some Countries - Read more

His daughter was murdered. Then she reappeared as an AI chatbot. - Read more

Google New nuclear clean energy agreement with Kairos Power - Read more

Microsoft's VP of GenAI research to join OpenAI - Read more

Boston Dynamics and Toyota Research Institute Announce Partnership to Advance Robotics Research - Read more

ChatGPT Topped 3 Billion Visits in September - Read more

Google.org announces $15 million in AI training grants for the government workforce - Read more

Alibaba’s international arm says its new AI translation tool beats Google and ChatGPT - Read more

“A man always has two reasons for doing anything—a good reason and the real reason.”

Top Article Picks this week

Welcome to this week's lifestyle and science digest, where we explore fascinating insights into human behavior, health, and the world around us. Our modern lives are filled with challenges and opportunities, from financial stability to technological impacts on our well-being. We start by examining the surprising volatility of high incomes and delve into the intricacies of large language models that power today's AI.

The struggle many Americans face with graph interpretation highlights the importance of data literacy in our information-rich world. On a lighter note, scientists are making strides in decoding the melodious language of birds. We then shift to personal experiences, with one individual's transformative journey swapping a smartphone for a flip phone. The pressing issue of AI safety is addressed through an innovative clock concept, shedding light on potential existential risks.

Relationships, fitness, and the simple act of walking are explored for their profound impacts on our lives. We also uncover the mystery of ancient mounds in the US and consider how we might better utilize our leisure time. The changing landscape of meteorology due to AI advancements is discussed, along with the surprising benefits of sibling relationships. Finally, we delve into the fascinating world of gut bacteria and their influence on our moods.

The Low Stability of High Income (Reading time: 5 min) - Read here

An Intuitive Guide to How LLMs Work (Reading time: 25 min) - Read here

Americans Struggle with Graphs (Reading time: 12 min) - Read here

How Scientists Started to Decode Birdsong (Reading time: 25 min) - Read here

I Traded My Smartphone For A Flip Phone For 100 Days. It Changed My Life. (Reading time: 10 min) - Read here

I Launched the AI Safety Clock. Here’s What It Tells Us About Existential Risks (Reading time: 5 min) - Read here

Seven Ways to Love Better (Reading time: 8 min) - Read here

The Secret to Getting in Shape When You’re Busy? Make Your Workouts Easier (Reading time: 5 min) - Read here

‘It’s a Superpower’: How Walking Makes Us Healthier, Happier and Brainier (Reading time: 10 min) - Read here

The US’ 2,000-Year-Old Mystery Mounds (Reading time: 10 min) - Read here

How to Stop Wasting Your Life Watching TV and Do Something Worthwhile With Your Downtime (Reading time: 4 min) - Read here

AI is changing my work as a meteorologist—Hurricane Helene and Milton proved there’s no going back (Reading time: 6 min) - Read here

How Your Siblings Can Make You Happier (Reading time: 6 min) - Read here

How Bacteria Are Changing Your Mood (Reading time: 6 min) - Read here

Weekly YouTube videos

Investment Bonus

🎇 Earn passive income with up to 15% APY.

❄ Why invest with Debitum? 0%* default rate in 5 years. Licensed and Regulated platform. Business loans. Secured by real collateral. Sustainable returns 11 – 15% p.a. BuyBack obligation and other protection mechanisms. You will get 25 EUR by using our invitation link below.

Debitum - Your number one choice for investing in business loans - Join Here!

“The older you get the more you realize that kindness is synonymous with happiness.”

Book of the week

"The Bitcoin Standard" by Saifedean Ammous offers a comprehensive exploration of Bitcoin's role in monetary history and its potential as a decentralized alternative to central banking. Ammous provides a thorough background on the evolution of money, from primitive systems to modern currencies, setting the stage for Bitcoin's emergence.

The author argues that Bitcoin represents a digital form of hard money, comparing it to gold in its scarcity and potential as a store of value. He examines Bitcoin's technological underpinnings and its economic properties, explaining how it operates as a decentralized system without relying on trusted third parties.

Ammous makes a compelling case for Bitcoin's significance, suggesting it could shift the balance of monetary power from governments to individuals. He addresses common criticisms and questions surrounding Bitcoin, including energy consumption, criminal use, and control issues.

While the book offers valuable insights into Bitcoin's potential, some readers may find Ammous's stance overly bullish. His critique of central banking and fiat currencies is sharp, which may not resonate with all economic perspectives.

Overall, "The Bitcoin Standard" serves as an essential resource for those seeking to understand Bitcoin's place in the broader context of monetary history and its possible implications for the future of finance. Whether you're a Bitcoin enthusiast or a skeptic, this book provides a thought-provoking analysis that challenges conventional notions of money and banking.

“Happiness is good health and a bad memory.”

And finally …

Join Trading 212 Invest with this link, and we will both get FREE shares.

Thanks for the read!

If you like what you read, forward it to your friends, so they can sign up here.