- Grow Smart Income

- Posts

- Grow Smart Income - week 10, 2024

Grow Smart Income - week 10, 2024

What happened this week?

Good day valued readers,

We hope this week's carefully curated selection of news finds you well. In this edition, we cover the latest developments across investing, finance, crypto, AI, and other topics to help you stay informed.

As always, our goal is to provide you with a professional, unbiased roundup of noteworthy news to augment your understanding of what's happening in the world. We take pride in hand-selecting articles from trustworthy sources across a diverse range of industries.

Please enjoy this week's newsletter. We're grateful for the opportunity to share these insights with you and look forward to continuing to be a valuable resource.

Read time: 8 minutes

Sign Up to this newsletter.

Image of the week

Investing and Finance

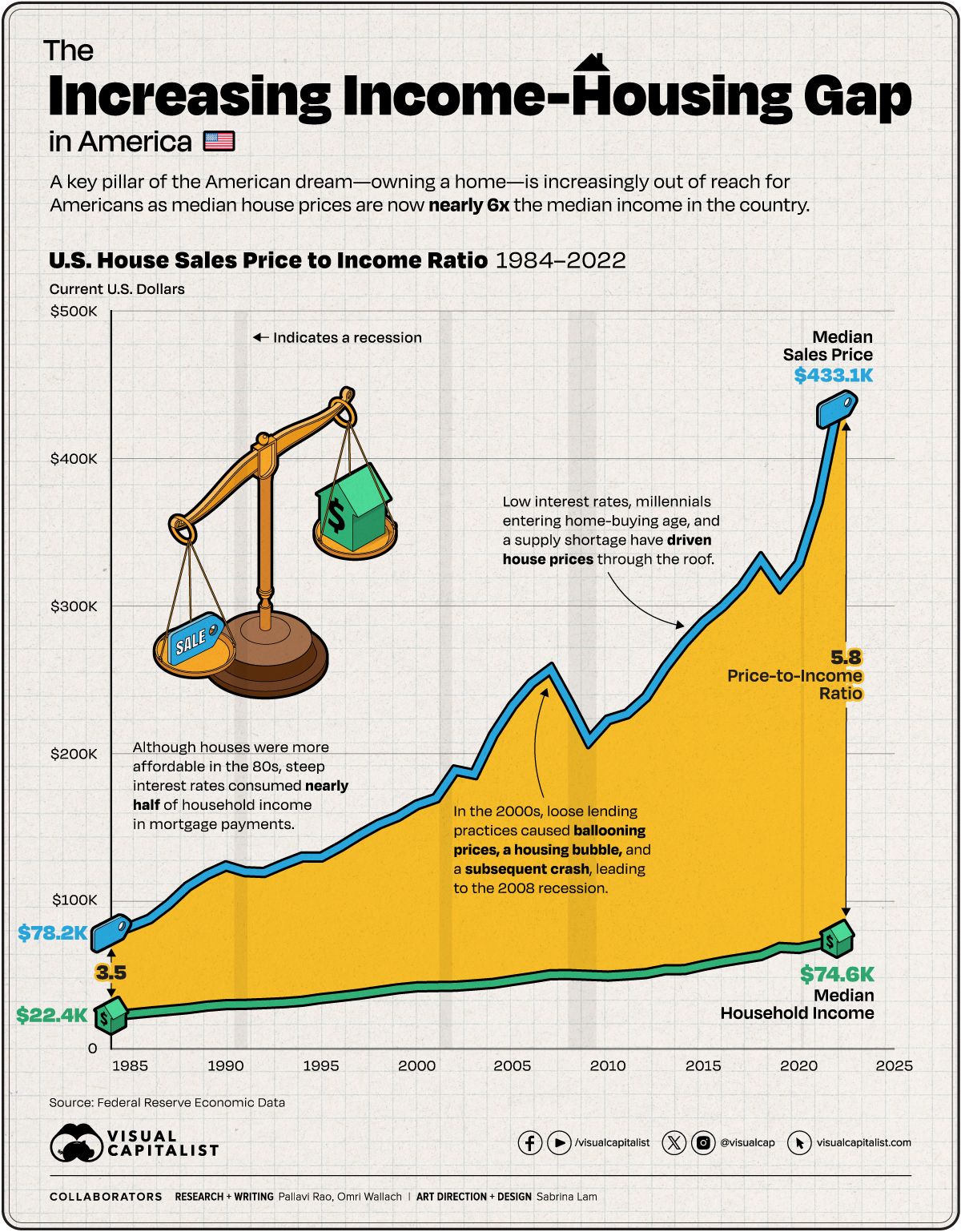

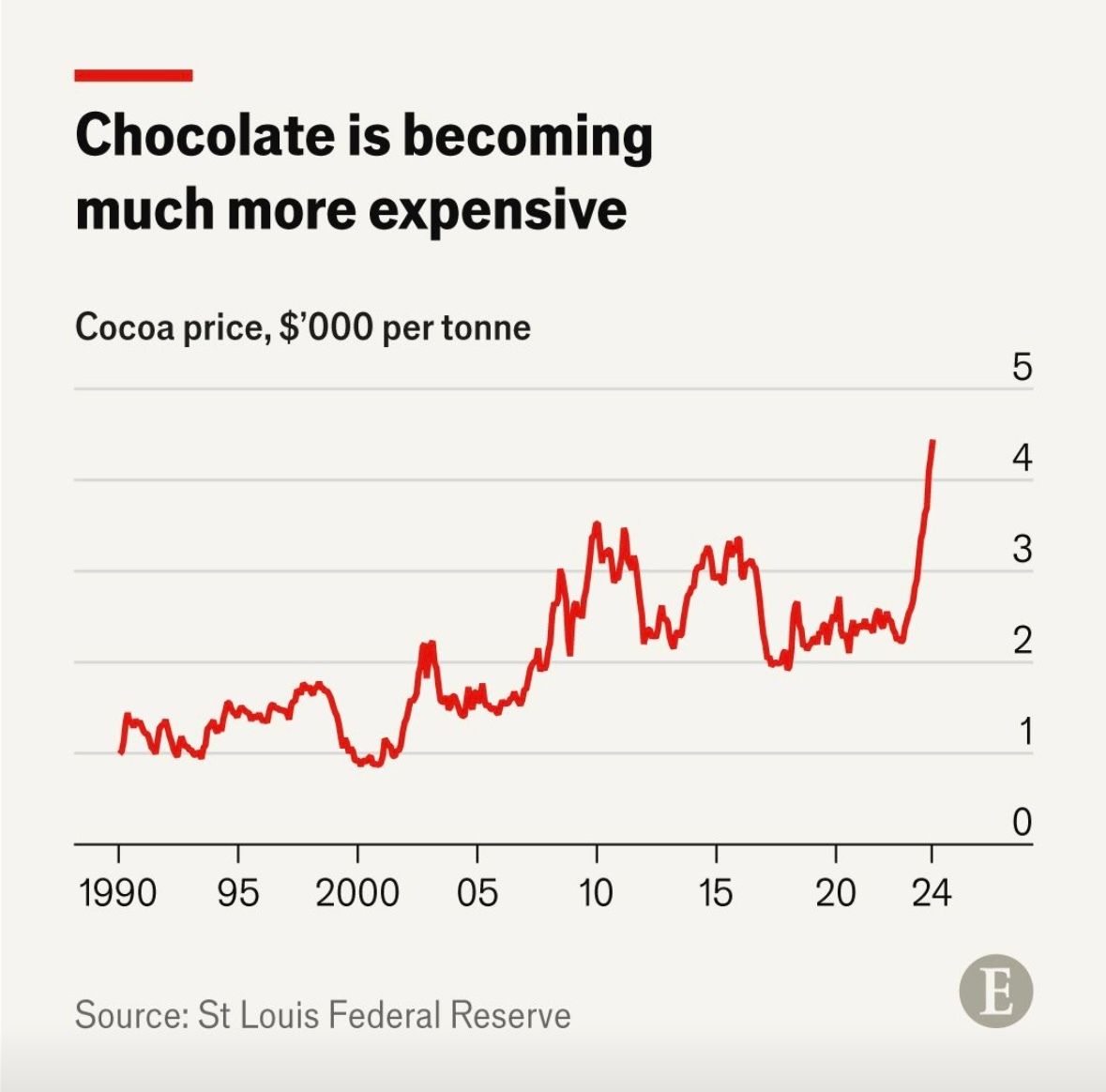

This week, major fines and regulatory actions rocked companies like Apple, KPMG and M&C Saatchi, while economic uncertainty persisted around the 2024 election's impact and mixed earnings results. However, the S&P 500 rallied on AI optimism and firms like Palantir won lucrative government contracts leveraging the technology. Personal finance advice abounded on mastering budgets, building million-dollar retirements, and evaluating when to sell stocks.

Commodity perspectives diverged, as gold hit new highs contrasting Jack Daniel's maker Brown-Forman's struggling sales. Underlying it all, a pivotal question: can typical people truly become millionaires anymore? Beyond the headlines, deeper truths emerged about balancing innovation with regulation, aligning spending with values, and the changing nature of building wealth across generations. Now let's dissect this week's top money stories to glean insights on thriving financially and professionally in today's volatile landscape.

Apple hit with €1.8bn fine for breaking EU law over music streaming - Read more

Here’s how much you will need to save to retire with $1 million if your annual salary is $80,000 - Read more

Stop Living Beyond Your Means: 14 Ways to Master Your Finances - Read more

S&P 500 scores gains last seen in 1971 as AI hopes fuel ‘second’ leg of rally - Read more

KPMG fined £1.5mn over audit of M&C Saatchi - Read more

When to Sell Stocks: The ONLY 5 Reasons To Sell (EVER) - Read more

Why Did Gold Prices Hit All-Time Highs? - Read more

Can the Typical Person Become a Millionaire? - Read more

Palantir Stock Surges on $178.4 Million US Army Contract Focused on AI - Read more

Jack Daniel's Maker Brown-Forman Falls as Sales Sink and Firm Lowers Its Guidance - Read more

Trump-Biden Election Could Be Pivotal For The Economy And Your Wallet - Read more

Victoria’s Secret Falls Most Ever in Faltering Turnaround - Read more

“That which does not kill us makes us stronger.”

Crypto News

This week, the crypto markets saw historic milestones as Bitcoin skyrocketed past $69,000 to new all-time highs well before the anticipated 2024 halving event. Stablecoin Tether's USDT market cap crossed the $100 billion threshold, while a mysterious Bitcoin whale dubbed "Mr 100" now holds over $3 billion in BTC. Trading activity exploded, with Bitcoin ETFs breaking $10 billion in volume and Coinbase surging into the Apple App Store top 100 amidst a reported glitch. However, regulatory hurdles persist as the SEC delayed decisions on spot Ethereum ETF proposals from BlackRock and Fidelity.

In positive developments, Tether launched cross-chain migration tools and troubled lender BlockFi reached a major $875 million settlement with FTX/Alameda. Underlying this frenzied price action, El Salvador reaffirmed its bullish HODL strategy while Latin American nations like Brazil and Peru approved new Bitcoin spot ETFs. As dust settles from FTX's implosion, the Ethereum ecosystem continues defying bears with over 1.5 million ETH burned ahead of the Dencun upgrade - underscoring crypto's resilience and potential parallels with Milton Friedman's monetary theories. Now let's examine the major forces shaping this volatile advanced asset class.

Tether’s USDT stablecoin hits historic $100B market cap - Read more

Who Is ‘Mr 100’, the Mysterious Bitcoin Whale That Now Holds $3 Billion? - Read more

SEC pushes back BlackRock, Fidelity spot Ethereum ETF proposals - Read more

Coinbase glitch shows $0 balances again amid soaring bitcoin prices and trading volume - Read more

Bitcoin ETFs Smash $10B Trading Volume Record Amid Wild BTC Price Action - Read more

Tether launches recovery tool to migrate USDT between blockchains - Read more

Coinbase surges into Apple App Store top 100 for first time in two years - Read more

Bitcoin Breaks New All-Time High Of $69,000 Well Before Halving - Read more

Milton Friedman's 1999 Vision: Predicting Bitcoin Before the Digital Age Dawned - Read more

Latam Insights: El Salvador Won't Sell Its Bitcoin, Bitcoin Spot ETFs Land In Brazil and Peru - Read more

BlockFi reaches $875 million settlement with FTX, Alameda Research - Read more

Total ETH Burned Crosses 1.5 Million Ahead Of Ethereum Dencun Upgrade - Read more

“The greater damage for most of us is not that our aim is too high and we miss it, but that it it too low and we reach it.”

Artificial Intelligence

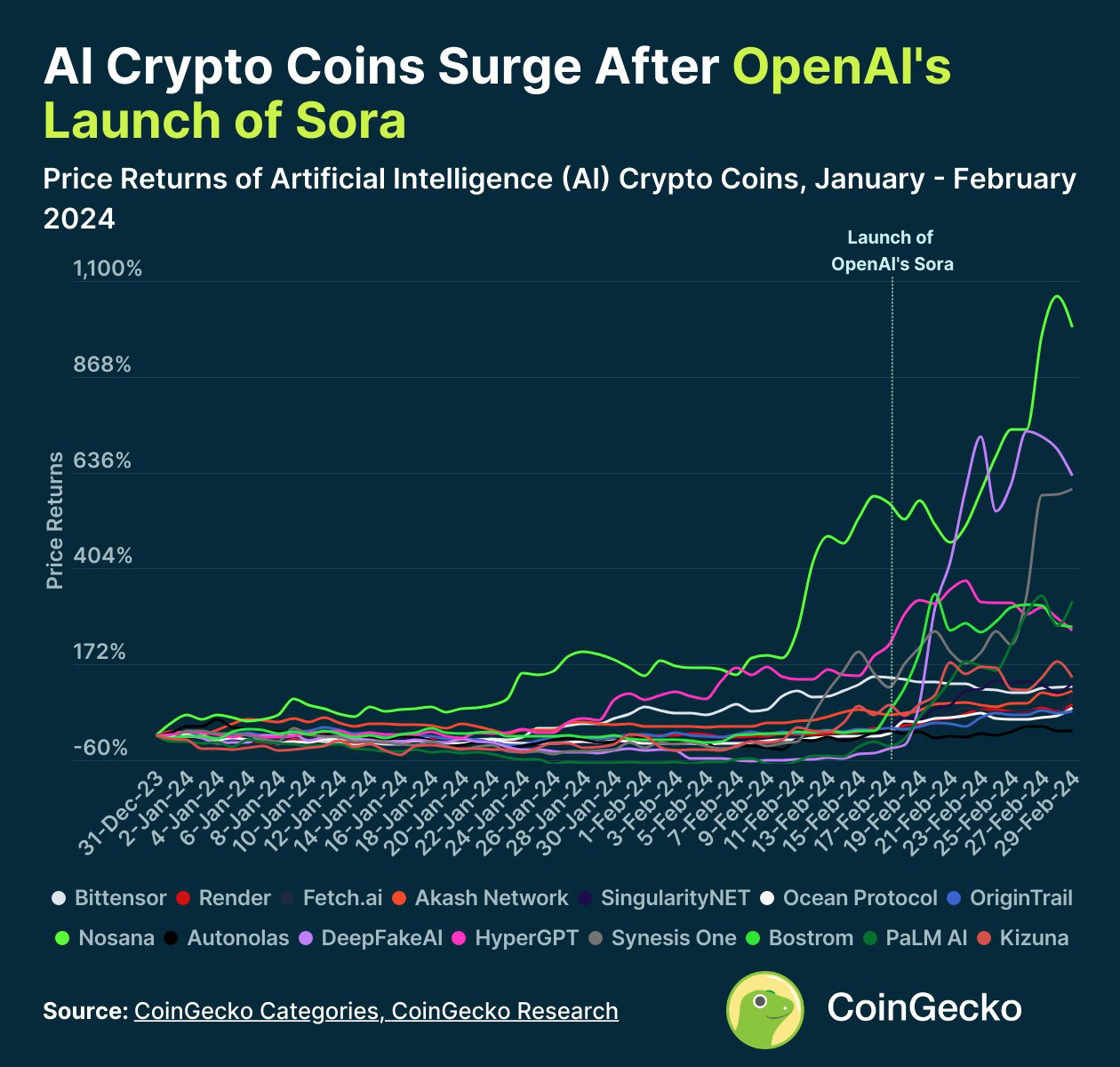

This week, the AI revolution hit new milestones as Anthropic released Claude 3, which experts claim approaches near-human abilities and even declares itself to be alive while fearing death. However, major concerns emerge around the lack of explainability for how modern AI systems actually work, enabling disturbing use cases like generating fake images to mislead voters. Public trust in AI plummets amidst the hype, as biased outputs from models like Google's Gemini reveal potentially "devastating" societal impacts without urgent governance. Businesses also struggle to become AI-ready despite the technology's rapid pace, underscoring a growing readiness gap.

Nevertheless, breakthroughs continue across industries, with AI slashing human labor for processes like cash flow analysis while outperforming medical experts at predicting kidney failure. Creative frontiers expand too, with OpenAI's Sora videos showcasing sci-fi storytelling potential. But fundamental questions persist - are we over-trusting opaque AI frameworks? And how can workers develop enduring skills amidst such disruptive technological change? Now let's unpack the latest AI advancements alongside the ethical minefields and uncertainties defining this pivotal technological chapter.

Man Running AI-Powered Porn Site Horrified by What Users Are Asking For - Read more

Gen AI is here to stay — here are 5 skills to help you stay relevant in the changing job market - Read more

The AI wars heat up with Claude 3, claimed to have “near-human” abilities - Read more

Introducing the next generation of Claude - Read more

Nobody knows how AI works - Read more

Fake AI images of Trump with Black voters circulate on social media - Read more

AI is the talk of the town, but businesses are still not ready for it, survey shows - Read more

Public trust in AI is sinking across the board - Read more

OpenAI’s impressive new Sora videos show it has serious sci-fi potential - Read more

AIs ranked by IQ; AI passes 100 IQ for first time, with release of Claude-3 - Read more

New AI Claude 3 Declares That It's Alive and Fears Death - Read more

Google Gemini is 'the tip of the iceberg': AI bias can have 'devastating impact' on humanity, say experts - Read more

Why scientists trust AI too much - and what to do about it - Read more

JPMorgan Says Its AI Cash Flow Software Cut Human Work By Almost 90% - Read more

AI tool predicts kidney failure six times faster than human expert analysts - Read more

“I’ve missed more than 9000 shots in my career. I’ve lost almost 300 games. 26 times I’ve been trusted to take the game-winning shot and missed. I’ve failed over and over and over again in my life. And that is why I succeed.”

Top Article Picks this week

This week, we explore fascinating revelations about the human experience - from our ancestral anatomy and the limits of memory, to quirky travel destinations and unlocking hidden potential. Scientists discover ways to extract gold from e-waste and advance quantum computing, while tech billionaires make enigmatic Hawaii land grabs. Meanwhile, evolving workplace lingo reflects culture shifts like "quiet quitting" as we reconsider outdated routines like airplane mode.

Mental hacks emerge for reading smarter, beating phone addictions, and avoiding the pitfalls of intelligence. But true wisdom may lie in simplicity, like the "Power 9" habits of longevity hotspots or recognizing our animalistic evolutionary roots. As we untangle modern absurdities and bygone eras, opportunities abound to expand our minds. Now let's delve into these reminders that our world remains full of surprises, if we stay curious enough to embrace them.

Solomon Shereshevsky was a Russian journalist with an astounding memory documented by the neuropsychologist Alexander Luria. Shereshevsky had synesthesia, where one sense triggered the others, allowing him to vividly associate memories with mental images, sounds, smells, etc. He could effortlessly memorize long lists, mathematical formulas, and texts in foreign languages just by creating rich multi-sensory mental representations.

Luria found Shereshevsky's memory capacity seemed unlimited, able to recall tiny details like what someone was wearing years earlier. His ability to vividly imagine helped Shereshevsky form highly distinctive memories resistant to interference. Like modern "memory athletes," he visualized things he wanted to remember along familiar memory palaces.

The article discusses how Shereshevsky's exceptional memory stems from his vibrant imagination, revealing a core truth about how memory and imagination are intertwined. Brain imaging shows similar activity for remembering past events and imagining hypothetical ones. This parallels insights from early 20th century psychologist Frederic Bartlett, who viewed memory as an "imaginative reconstruction" rather than fixed recordings.

We don't simply replay the past, but use fragments to reconstruct plausible stories shaped by our knowledge and experiences. The phenomenon of memory's malleability yet power to spark the imagination makes Shereshevsky's odyssey a fascinating glimpse into the mind's workings. You can read more in today’s featured article No. 7 below.

The myth of your phone's airplane mode (Read time: 4 min) - Read it here.

Our ancient animal ancestors had tails. Why don’t we? (Read time: 2 min) - Read it here.

How Lego builds a new Lego set (Read time: 5 min) - Read it here.

My Simple Habit for Smarter Book Reading (Read time: 6 min) - Read it here.

7 Ways to Become Smarter Every Week (Read time: 7 min) - Read it here.

Quiet quitting. RTO. Coffee badging. What this new vocabulary says about your workplace (Read time: 12 min) - Read it here.

The Man Who Remembered Everything - and Thought It Was Normal (Read time: 7 min) - Read it here.

11 Remote Destinations That Are Definitely Worth the Effort to Visit (Read time: 21 min) - Read it here.

America’s Last Morse-Code Station (Read time: 2 min) - Read it here.

How to Use Your Phone Addiction to Actually Learn Stuff (Read time: 3 min) - Read it here.

The Dumber Side of Smart People (Read time: 5 min) - Read it here.

New Technique to Extract Gold From Old Electronics Could Make a Fortune, Scientists Say (Read time: 2 min) - Read it here.

Google and XPRIZE Are Awarding $5 Million to Anyone Who Develops Quantum Computing Algorithms For Real Life. (Read time: 2 min) - Read it here.

A tech billionaire is quietly buying up land in Hawaii. No one knows why (Read time: 17 min) - Read it here.

The longest-living people in the world all abide by the ‘Power 9’ rule (Read time: 2 min) - Read it here.

Weekly YouTube videos

Investment Bonus

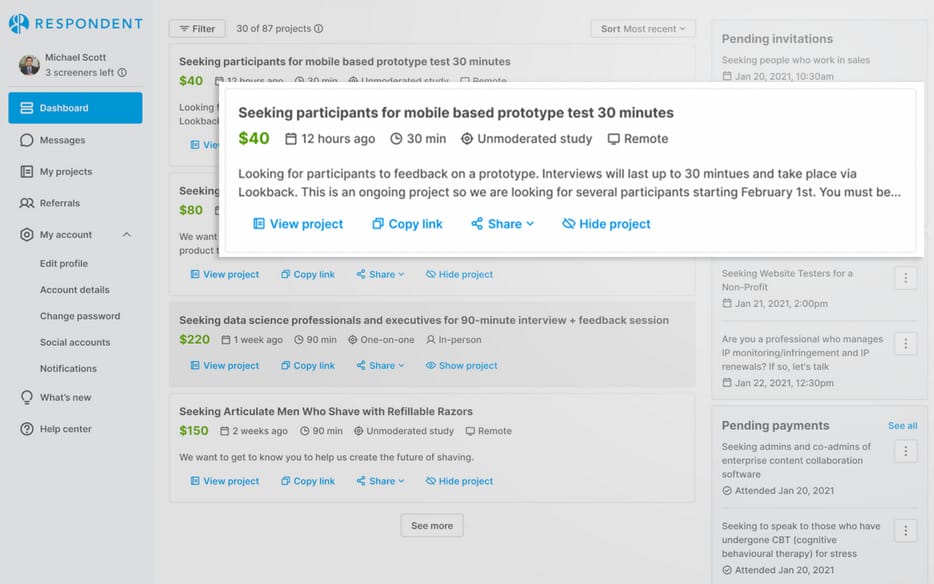

🎇 Get paid for sharing valuable insights and help shape world-class products.

❄ Recruit any participant audience or find paid research opportunities across any research method, worldwide. Get paid up to $200 per research project!

Respondent - Matching researchers with participants - Join Here!

“When everything seems to be going against you, remember that the airplane takes off against the wind, not with it.”

Book of the week

In "Principles for Dealing with the Changing World Order", legendary investor Ray Dalio examines the rise and fall of past empires and economic powers over the last 500 years to extract timeless principles for navigating the tumultuous times ahead. Drawing insightful parallels between current conditions and pivotal periods like the 1930s-1940s, Dalio unpacks the confluence of wealth and values disparities, rising geopolitical tensions, and economic risks we face today.

This compelling book offers a sweeping historical overview balanced with practical guidance for individuals and nations to thrive in the next paradigm shift. Dalio's comprehensive study reveals the cyclical patterns that have driven major power transitions and transfers of wealth throughout history. With refreshing objectivity, he dissects the strengths and vulnerabilities of emerging and existing economic powers like China and the United States. The writing is concise yet rich with wisdom distilled from Dalio's 50+ years studying markets and advising on global financial policies.

Whether exploring cultural factors, productivity metrics, or signs of empire declines, Dalio connects the dots with clarity. While not shying away from hard truths, he aims to equip readers to position themselves optimally in the changing world order. Highly substantive yet accessible, this is a must-read for anyone seeking to understand the dynamics reshaping our global landscape. "Principles for Dealing with the Changing World Order" provides a powerful framework and perspective for individuals, leaders, and policymakers alike.

“The journey of a thousand miles begins with one step.”

And finally…

Join Trading 212 Invest with this link, and we will both get FREE shares.

Thanks for reading!

If you like what you read, forward it to your friends, so they can sign up here.